We help you identify, achieve and maintain your desired lifestyle without fear of ever running out of money no matter what happens.

We help you identify, achieve and maintain your desired lifestyle without fear of ever running out of money no matter what happens.

We build a financial plan by gathering comprehensive information about you and your finances. Then we use a detailed Cash Flow forecast to give our decisions a context and assess its viability by seeing the impact on your wealth over your lifetime.

Cash Flow forecasting is an extremely valuable tool that allows us to work closely with clients to establish a Base Plan. This then allows us to plan “what if” scenarios to see the effect of various future events or major lifestyle decisions.

Choosing someone you trust to manage your financial affairs is not a decision to be taken lightly. If you’d like to find out more get in touch today: [email protected] or 087 133 2680

Our ultimate goal is to help clients identify and maintain their desired lifestyle without the FEAR of ever running out of money no matter what happens.

This is an alternative approach to financial services which involves telling people the truth about money. And truth about money has nothing to do with, “This pension plan is better than this one or that savings policy is the best”. Clients want to know how much is the life they want going to cost them?

Until I know about a client and what they are trying to achieve, I have no right to talk to them about or tell them what to do with their money. I can’t guarantee that clients will have any interest or benefit from what I have to say…only they can decide that after an initial meeting. This meeting is at our expense and no cost to you.

Comprehensive lifestyle financial planning encompasses 3 main parts;

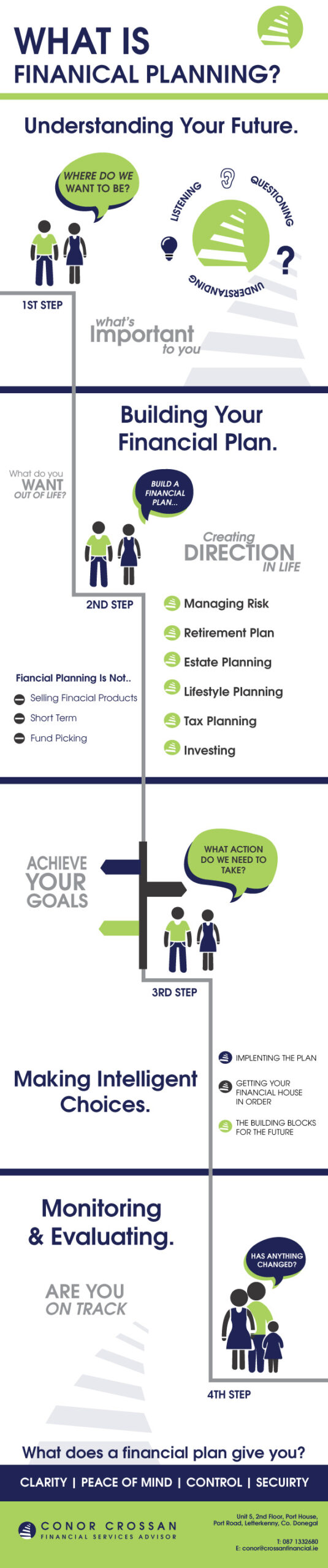

Life Plan – Step one is essentially about getting to know you. Where you are now on your journey, where you came from and where you would like to go (desired lifestyle). It is important to engage on a deep level to really understand what you truly want out of life because life is not a rehearsal and time is passing by!! The information gathered forms the basis of the Life Plan.

Financial Plan – Step two involves identifying the resources you have at your disposal today, what you will have going forward on an on-going basis Eg. Salary, rental income, child benefits etc.. Finally and sometimes more importantly identifying what may need to become available in order to achieve the Life Plan.

Financial Advice – Step three is in my opinion the least important aspect of the process. Only after completing step 1 & 2 and only if the life plan and financial plan suggest a financial product is required will we look to see the best fit. At this stage both you and I will fully understand what we’re trying to achieve and why a financial product is required. No one is going to be sold a pension or an investment because it sounds like a good idea!